Can A Tsp Hardship Withdrawal Be Denied . beginning september 15, 2019, taking a financial hardship withdrawal will have no effect on a participant’s. a thrift savings plan (tsp) hardship withdrawal allows federal employees and members of the uniformed services to. hardship requests cannot be taken for expenses already paid or those that are reimbursable. a hardship withdrawal from your tsp is generally taxable as ordinary income. no, you can have up to 2 conventional tsp loans (general/residential) and still make a hardship withdrawal This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing the amount of tax you owe.

from www.financestrategists.com

a hardship withdrawal from your tsp is generally taxable as ordinary income. beginning september 15, 2019, taking a financial hardship withdrawal will have no effect on a participant’s. no, you can have up to 2 conventional tsp loans (general/residential) and still make a hardship withdrawal hardship requests cannot be taken for expenses already paid or those that are reimbursable. a thrift savings plan (tsp) hardship withdrawal allows federal employees and members of the uniformed services to. This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing the amount of tax you owe.

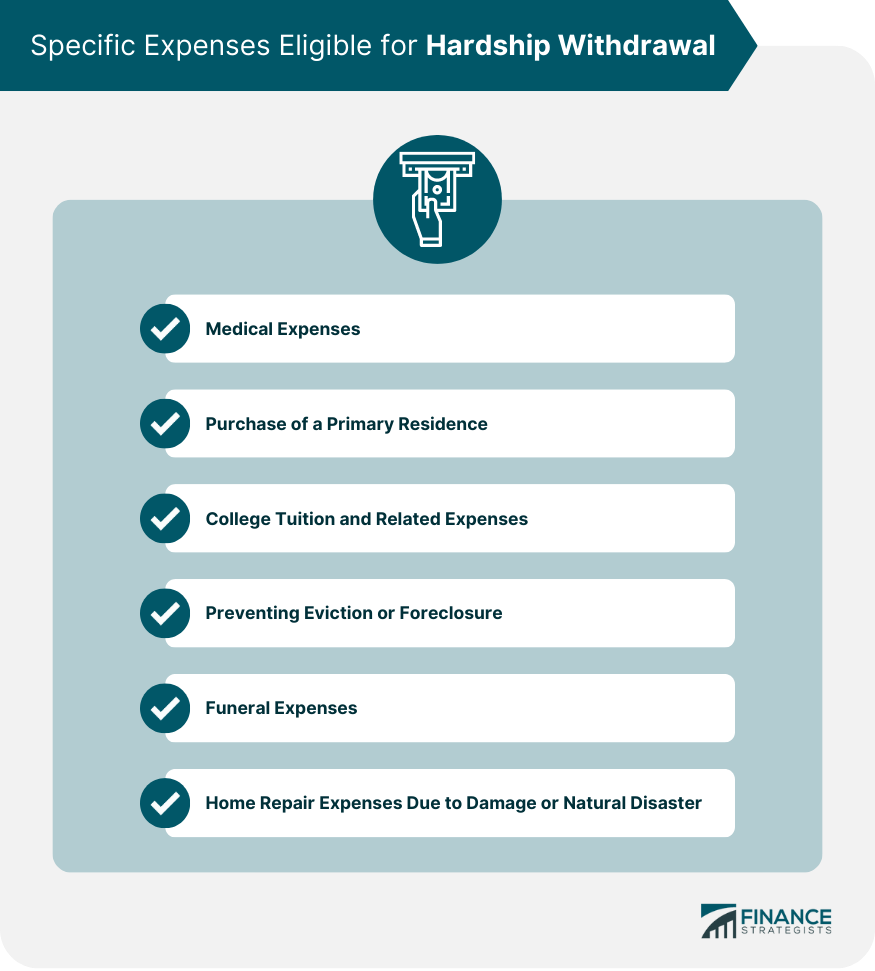

Hardship Withdrawal Definition, Types, Criteria, & Process

Can A Tsp Hardship Withdrawal Be Denied beginning september 15, 2019, taking a financial hardship withdrawal will have no effect on a participant’s. This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing the amount of tax you owe. hardship requests cannot be taken for expenses already paid or those that are reimbursable. no, you can have up to 2 conventional tsp loans (general/residential) and still make a hardship withdrawal a hardship withdrawal from your tsp is generally taxable as ordinary income. a thrift savings plan (tsp) hardship withdrawal allows federal employees and members of the uniformed services to. beginning september 15, 2019, taking a financial hardship withdrawal will have no effect on a participant’s.

From www.youtube.com

TSP Loan vs. Hardship Withdrawal What's Right for You? YouTube Can A Tsp Hardship Withdrawal Be Denied hardship requests cannot be taken for expenses already paid or those that are reimbursable. a hardship withdrawal from your tsp is generally taxable as ordinary income. a thrift savings plan (tsp) hardship withdrawal allows federal employees and members of the uniformed services to. beginning september 15, 2019, taking a financial hardship withdrawal will have no effect. Can A Tsp Hardship Withdrawal Be Denied.

From formswift.com

TSP76 Fillable Financial Hardship InService Withdrawal PDF Can A Tsp Hardship Withdrawal Be Denied a thrift savings plan (tsp) hardship withdrawal allows federal employees and members of the uniformed services to. This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing the amount of tax you owe. beginning september 15, 2019, taking a financial hardship withdrawal. Can A Tsp Hardship Withdrawal Be Denied.

From www.myfederalretirement.com

TSP Hardship Withdrawal Options Would Expand Under Proposal Can A Tsp Hardship Withdrawal Be Denied a hardship withdrawal from your tsp is generally taxable as ordinary income. a thrift savings plan (tsp) hardship withdrawal allows federal employees and members of the uniformed services to. This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing the amount of. Can A Tsp Hardship Withdrawal Be Denied.

From www.financestrategists.com

Hardship Withdrawal Definition, Types, Criteria, & Process Can A Tsp Hardship Withdrawal Be Denied This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing the amount of tax you owe. a thrift savings plan (tsp) hardship withdrawal allows federal employees and members of the uniformed services to. no, you can have up to 2 conventional tsp. Can A Tsp Hardship Withdrawal Be Denied.

From mungfali.com

TSP Withdrawal Form Printable Can A Tsp Hardship Withdrawal Be Denied no, you can have up to 2 conventional tsp loans (general/residential) and still make a hardship withdrawal This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing the amount of tax you owe. a thrift savings plan (tsp) hardship withdrawal allows federal. Can A Tsp Hardship Withdrawal Be Denied.

From braviasfinancial.com

[VIDEO] TSP Financial Hardship Withdrawals Bravias Financial Can A Tsp Hardship Withdrawal Be Denied no, you can have up to 2 conventional tsp loans (general/residential) and still make a hardship withdrawal hardship requests cannot be taken for expenses already paid or those that are reimbursable. a thrift savings plan (tsp) hardship withdrawal allows federal employees and members of the uniformed services to. a hardship withdrawal from your tsp is generally. Can A Tsp Hardship Withdrawal Be Denied.

From ifasifinancial.com

Withdrawing your TSP after leaving Federal Service TSP Withdrawal Can A Tsp Hardship Withdrawal Be Denied beginning september 15, 2019, taking a financial hardship withdrawal will have no effect on a participant’s. no, you can have up to 2 conventional tsp loans (general/residential) and still make a hardship withdrawal hardship requests cannot be taken for expenses already paid or those that are reimbursable. a hardship withdrawal from your tsp is generally taxable. Can A Tsp Hardship Withdrawal Be Denied.

From www.youtube.com

New TSP Hardship Withdrawal Option Financial Advisor Christy Can A Tsp Hardship Withdrawal Be Denied hardship requests cannot be taken for expenses already paid or those that are reimbursable. beginning september 15, 2019, taking a financial hardship withdrawal will have no effect on a participant’s. a thrift savings plan (tsp) hardship withdrawal allows federal employees and members of the uniformed services to. no, you can have up to 2 conventional tsp. Can A Tsp Hardship Withdrawal Be Denied.

From investguiding.com

New TSP withdrawal options are live. Here’s what you need to know Can A Tsp Hardship Withdrawal Be Denied a thrift savings plan (tsp) hardship withdrawal allows federal employees and members of the uniformed services to. no, you can have up to 2 conventional tsp loans (general/residential) and still make a hardship withdrawal This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket. Can A Tsp Hardship Withdrawal Be Denied.

From governmentworkerfi.com

Personal Casualty Losses and TSP Hardship Withdrawals Government Can A Tsp Hardship Withdrawal Be Denied a hardship withdrawal from your tsp is generally taxable as ordinary income. beginning september 15, 2019, taking a financial hardship withdrawal will have no effect on a participant’s. no, you can have up to 2 conventional tsp loans (general/residential) and still make a hardship withdrawal a thrift savings plan (tsp) hardship withdrawal allows federal employees and. Can A Tsp Hardship Withdrawal Be Denied.

From www.fedsmith.com

Temporarily Relaxing TSP Hardship Withdrawal Rules Can A Tsp Hardship Withdrawal Be Denied This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing the amount of tax you owe. hardship requests cannot be taken for expenses already paid or those that are reimbursable. a hardship withdrawal from your tsp is generally taxable as ordinary income.. Can A Tsp Hardship Withdrawal Be Denied.

From draftdestiny.com

401k Hardship Withdrawal Letter Draft Destiny Can A Tsp Hardship Withdrawal Be Denied hardship requests cannot be taken for expenses already paid or those that are reimbursable. This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing the amount of tax you owe. no, you can have up to 2 conventional tsp loans (general/residential) and. Can A Tsp Hardship Withdrawal Be Denied.

From www.financestrategists.com

Hardship Withdrawal Definition, Types, Criteria, & Process Can A Tsp Hardship Withdrawal Be Denied a hardship withdrawal from your tsp is generally taxable as ordinary income. hardship requests cannot be taken for expenses already paid or those that are reimbursable. This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing the amount of tax you owe.. Can A Tsp Hardship Withdrawal Be Denied.

From www.youtube.com

Can I Withdraw Money From TSP Before I Retire ?TSP Withdrawal From Your Can A Tsp Hardship Withdrawal Be Denied no, you can have up to 2 conventional tsp loans (general/residential) and still make a hardship withdrawal a hardship withdrawal from your tsp is generally taxable as ordinary income. a thrift savings plan (tsp) hardship withdrawal allows federal employees and members of the uniformed services to. This means the amount you withdraw will be added to your. Can A Tsp Hardship Withdrawal Be Denied.

From rumble.com

What is a hardship withdrawal? Can A Tsp Hardship Withdrawal Be Denied hardship requests cannot be taken for expenses already paid or those that are reimbursable. beginning september 15, 2019, taking a financial hardship withdrawal will have no effect on a participant’s. no, you can have up to 2 conventional tsp loans (general/residential) and still make a hardship withdrawal a thrift savings plan (tsp) hardship withdrawal allows federal. Can A Tsp Hardship Withdrawal Be Denied.

From www.dopkins.com

Changes to Hardship Withdrawal Restrictions Dopkins & Co LLP Can A Tsp Hardship Withdrawal Be Denied beginning september 15, 2019, taking a financial hardship withdrawal will have no effect on a participant’s. a hardship withdrawal from your tsp is generally taxable as ordinary income. This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing the amount of tax. Can A Tsp Hardship Withdrawal Be Denied.

From www.signnow.com

Transamerica Hardship Withdrawal Complete with ease airSlate SignNow Can A Tsp Hardship Withdrawal Be Denied no, you can have up to 2 conventional tsp loans (general/residential) and still make a hardship withdrawal hardship requests cannot be taken for expenses already paid or those that are reimbursable. This means the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing the. Can A Tsp Hardship Withdrawal Be Denied.

From www.fedsmith.com

TSP Hardship Withdrawals And Hurricane Harvey Can A Tsp Hardship Withdrawal Be Denied a thrift savings plan (tsp) hardship withdrawal allows federal employees and members of the uniformed services to. no, you can have up to 2 conventional tsp loans (general/residential) and still make a hardship withdrawal beginning september 15, 2019, taking a financial hardship withdrawal will have no effect on a participant’s. hardship requests cannot be taken for. Can A Tsp Hardship Withdrawal Be Denied.